Did you know that nearly 40% of Americans can’t cover a $400 emergency without borrowing? Let’s change that. In this comprehensive guide, I’ll show you exactly how to build your first $1,000 emergency fund in just three months, even if you’re living paycheck to paycheck.

Why You Need an Emergency Fund

Before we dive into the how-to, let’s understand why having an emergency fund isn’t just nice to have – it’s essential for your financial well-being.

The True Cost of Financial Emergencies

When unexpected expenses hit without savings, many people turn to credit cards or payday loans. A $400 car repair can quickly turn into $600 or more with high-interest debt. An emergency fund breaks this costly cycle and provides immediate peace of mind.

Benefits of Having $1,000 Saved

Having $1,000 saved can:

- Cover most common emergencies

- Reduce financial stress

- Prevent high-interest debt

- Provide financial confidence

- Give you breathing room between paychecks

Setting Up Your Emergency Fund

Success starts with the right foundation. Let’s set up your emergency fund properly from the beginning.

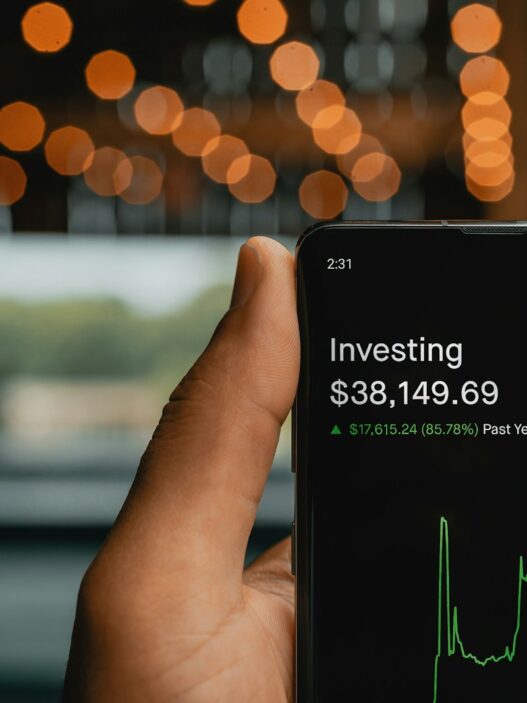

Choosing the Right Account

Your emergency fund needs to be:

- Easily accessible (liquid)

- Separate from your checking account

- In a high-yield savings account

- Free from monthly fees

Look for online banks offering competitive interest rates and no minimum balance requirements. While the interest won’t make you rich, every little bit helps.

Creating a Realistic Timeline

Breaking down $1,000 over three months means saving about $334 per month or $83 per week. We’ll make this even more manageable by front-loading the savings in month one when motivation is highest.

Monthly Breakdown to Reach $1,000

Let’s break this down month by month with specific, actionable steps.

Month 1: Quick Wins ($400)

Week 1-2:

- Cancel unused subscriptions ($30-50)

- Sell unused items ($100-150)

- Pack lunches instead of buying ($60)

- Skip two takeout meals ($40)

- Use cashback apps for groceries ($20)

- Reduce utility usage ($30)

- Challenge yourself to a no-spend weekend ($70)

Month 2: Building Momentum ($300)

- Complete online surveys ($30)

- Start food planning to reduce grocery bills ($50)

- Pick up one food delivery shift ($70)

- Reduce entertainment expenses ($50)

- Find cheaper phone plan ($30)

- Use libraries instead of buying books/movies ($20)

- Collect and return recyclables ($50)

Month 3: Final Push ($300)

- Continue meal planning ($50)

- Another no-spend weekend ($70)

- Additional food delivery shift ($70)

- Sell more items ($60)

- Use cashback apps ($30)

- Reduce utility bills further ($20)

Money-Saving Strategies

Let’s dive deeper into strategies that will help you reach your goal faster.

Immediate Expense Reduction

Look for quick wins in your current spending:

- Audit all subscriptions and memberships

- Switch to generic brands

- Use apps to find cheapest gas prices

- Install a programmable thermostat

- Use cash for discretionary spending

Finding Extra Income

Every extra dollar counts:

- Sign up for food delivery platforms

- Offer pet-sitting services

- Do online freelance work

- Participate in market research

- Take on overtime at work if available

Automating Your Savings

Make saving automatic and painless:

- Set up direct deposit to your emergency fund

- Use round-up apps for spare change

- Schedule transfers for payday

- Set up automatic bill pay to avoid late fees

- Use apps that gamify saving

Maintaining Your Emergency Fund

Building your fund is just the beginning. Knowing how to use and maintain it is crucial for long-term success.

When to Use It

Your emergency fund should only be used for true emergencies:

- Medical expenses

- Car repairs

- Job loss

- Essential home repairs

- Family emergencies

Not emergencies:

- Planned expenses

- Holiday shopping

- Sales or deals

- Non-essential purchases

- Regular maintenance

How to Replenish It

After using your emergency fund:

- Make a plan to replenish within 3 months

- Look for additional income sources

- Cut back on non-essential spending

- Consider selling items

- Use any windfalls (tax returns, bonuses)

Conclusion

Building a $1,000 emergency fund in three months is an achievable goal that will transform your financial security. Remember, every dollar saved is a step toward financial freedom. Start today, stay consistent, and watch your emergency fund grow.

Frequently Asked Questions

Q1: What if I can’t save the full amount each month?

A: Any amount saved is better than none. Adjust the timeline if needed, but keep moving forward. Even saving $50 a month will eventually get you there.

Q2: Should I build an emergency fund while I have debt?

A: Yes! Having a small emergency fund prevents you from taking on more debt when emergencies occur. Focus on $1,000 first, then tackle high-interest debt.

Q3: Where’s the best place to keep my emergency fund?

A: A high-yield savings account separate from your regular bank provides the best balance of accessibility and growth potential.

Q4: What if I need to use the fund before reaching $1,000?

A: That’s exactly what it’s there for! Use what you need and start building it back up. Don’t get discouraged – this proves why having an emergency fund is so important.

Q5: How can I stay motivated during the saving process?

A: Track your progress visually, celebrate small wins, and remember why you started. Each dollar saved is a step toward financial security.