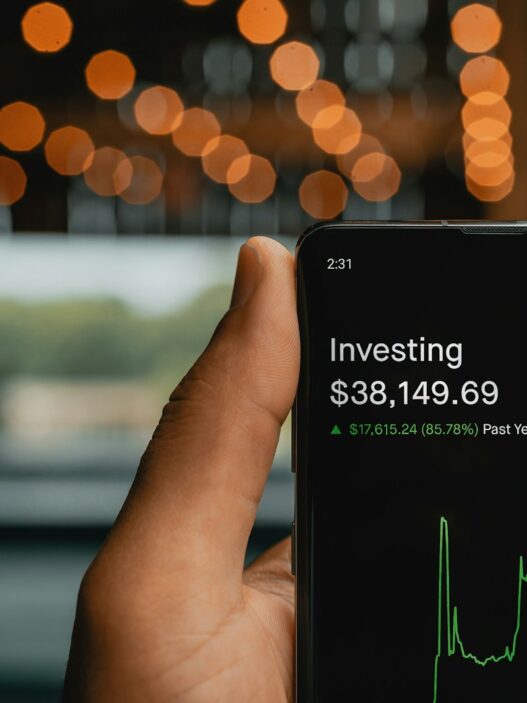

What Is an Index Fund?

An index fund is a type of investment that tracks a market index, such as the S&P 500 or the Nasdaq Composite. Instead of trying to beat the market by picking individual stocks, index funds aim to match the performance of their target index by holding all (or a representative sample) of the securities in that index.

Why Choose Index Funds?

Low Costs

Index funds typically have much lower expense ratios than actively managed funds because they:

- Don’t require teams of analysts

- Have lower trading costs

- Follow a passive investment strategy

Built-in Diversification

When you buy an index fund, you’re instantly investing in hundreds or thousands of different companies, which helps spread your risk across various sectors and companies.

Proven Track Record

Historically, index funds have outperformed the majority of actively managed funds over long periods. This is partly due to their lower fees and the difficulty active managers face in consistently beating the market.

Types of Index Funds

Stock Market Index Funds

- Total Market Funds (e.g., Vanguard Total Stock Market Index Fund)

- Large-Cap Funds (e.g., S&P 500 index funds)

- Mid-Cap and Small-Cap Index Funds

- International Market Index Funds

Bond Index Funds

- Total Bond Market Funds

- Government Bond Funds

- Corporate Bond Funds

- Municipal Bond Funds

Specialty Index Funds

- Real Estate Investment Trust (REIT) Index Funds

- Sector-Specific Index Funds

- Dividend Index Funds

How to Start Investing in Index Funds

Step 1: Choose Your Investment Platform

Several platforms offer access to index funds:

- Traditional brokerages (Vanguard, Fidelity, Charles Schwab)

- Online brokers (E*TRADE, TD Ameritrade)

- Robo-advisors (Betterment, Wealthfront)

Step 2: Determine Your Investment Goals

Consider:

- Your time horizon

- Risk tolerance

- Investment objectives (retirement, house down payment, etc.)

- Regular contribution amount

Step 3: Select Your First Index Fund

For beginners, consider starting with:

- A broad market index fund (S&P 500 or Total Market)

- Low expense ratio (ideally under 0.1%)

- No investment minimums or low minimums

- High trading volume for better liquidity

Step 4: Set Up Regular Investments

- Establish automatic monthly contributions

- Consider dollar-cost averaging

- Reinvest dividends automatically

Building Your Index Fund Portfolio

Basic Portfolio Examples

Conservative Portfolio (Age 60+)

- 40% Total Stock Market Index Fund

- 60% Total Bond Market Index Fund

Moderate Portfolio (Age 40-60)

- 60% Total Stock Market Index Fund

- 30% Total Bond Market Index Fund

- 10% International Stock Index Fund

Aggressive Portfolio (Under 40)

- 70% Total Stock Market Index Fund

- 20% International Stock Index Fund

- 10% Total Bond Market Index Fund

Common Index Fund Investing Mistakes to Avoid

- Trying to Time the Market

Focus on regular contributions rather than trying to buy at the “perfect” time. - Overcomplicating Your Portfolio

Start simple with one or two broad-market funds before adding complexity. - Focusing Too Much on Short-Term Performance

Index investing is a long-term strategy. Don’t let short-term market fluctuations discourage you. - Neglecting International Exposure

Consider adding international index funds for global diversification.

Tax Considerations

Tax-Advantaged Accounts

Consider holding index funds in:

- 401(k)s

- Traditional IRAs

- Roth IRAs

- HSAs (Health Savings Accounts)

Taxable Accounts

If investing in taxable accounts:

- Look for tax-efficient index funds

- Consider municipal bond index funds

- Be aware of capital gains distributions

Monitoring and Rebalancing Your Portfolio

Regular Review Schedule

- Check your portfolio quarterly

- Rebalance annually or when allocations drift more than 5%

- Review your investment goals yearly

What to Monitor

- Asset allocation

- Fund expense ratios

- Portfolio performance vs. benchmarks

- Life changes that might affect your strategy

Conclusion

Index fund investing offers a simple, low-cost way to build long-term wealth. By starting with broad-market funds, maintaining regular contributions, and staying focused on your long-term goals, you can create a solid foundation for your financial future.

Remember: The key to successful index fund investing isn’t finding the “perfect” fund or timing the market perfectly. It’s about consistency, patience, and maintaining a long-term perspective.

Want to learn more about building wealth through smart investing? Explore our other articles on financial independence at onethousanddollarsamonth.com.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.